Strategies for Asset Protection

Basic Principles and Strategies for Safeguarding Your Wealth

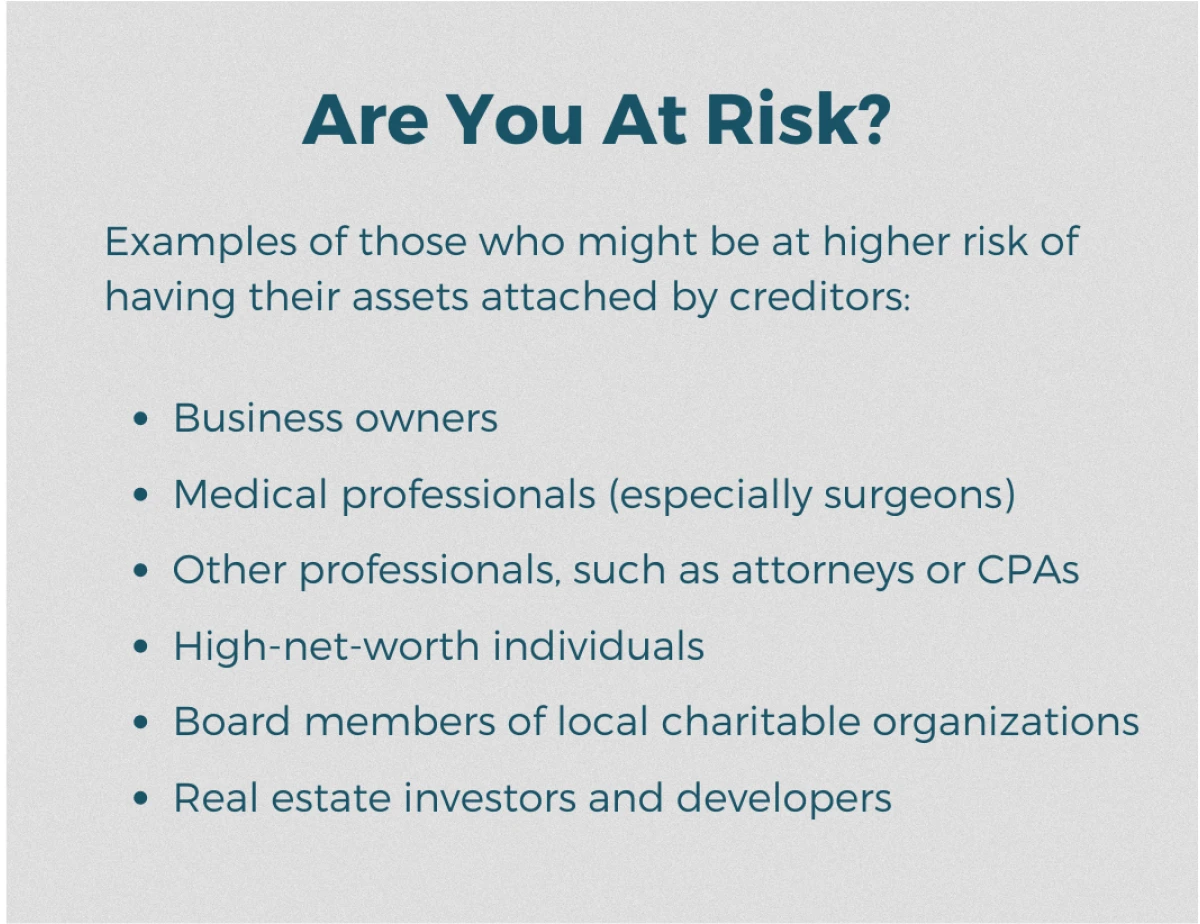

Asset protection is a part of any financial plan. If you have accumulated substantial retirement savings or equity in your home, it is important to consider how to protect these assets against a lawsuit, civil claim, or bankruptcy proceeding.

Asset protection is usually associated with individuals who have high net worth, business owners and professionals like doctors. These people are at a high risk of becoming litigation targets. People with modest assets such as retirement savings and a home, should also consider creating a protection plan. Assets can be put at risk by claims and lawsuits arising from car accidents, injuries on your property, and family liabilities.

Asset protection is often a last-minute or non-existent thought for many people. It is therefore important to protect your assets in advance. A proper plan will help you to maintain your lifestyle and pass your assets on to your heirs or charitable organizations.

There are no fool-proof plans, but there are many strategies and tools that can be used. Remember to consult with a tax or legal expert to identify your specific risks and assets that you want to protect.

This article will explore different ways to prevent your retirement assets and other assets, such as non-liquid assets like your home, from falling into the wrong hands. Consult your financial advisor to find out what is best for you.

Protect Your Retirement Assets

Retirement assets are divided into two groups: those that qualify under the Employee Retirement Insurance Security Act (ERISA) of 1974, and those who do not. This includes individual retirement accounts. ERISA plans have full protection against creditors, regardless of whether an individual files bankruptcy.*

According to the U.S. Supreme Court in Patterson v. Shumate (1992), pensions, profit sharing plans, and other employee-sponsored retirement plans like 401(k)s are examples of ERISA qualified retirement plans.

*There are certain limited exceptions, including claims made by the Internal Revenue Service or criminal penalties. They also apply to divorce proceedings and other matters that fall under a qualified domestic relation order.

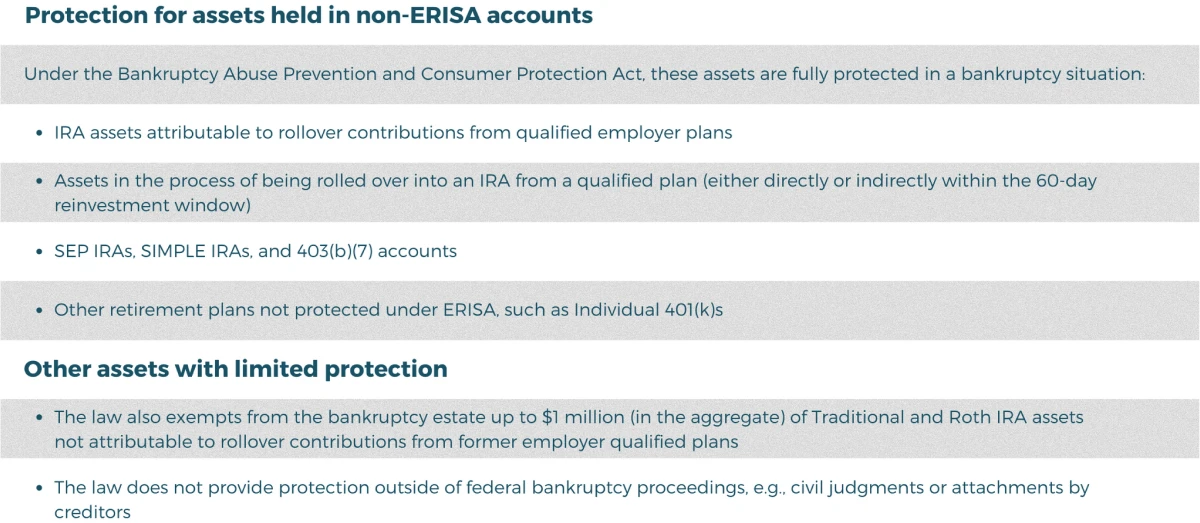

Non-ERISA accounts get limited protection

In the spring of 2005, President Bush passed the Bankruptcy Abuse Prevention and Consumer Protection Act. This law addressed a major disadvantage that IRAs had in terms of creditor protection.

The Act, in addition to imposing stricter rules for individuals and businesses who file for bankruptcy protection, extended federal protections for assets within IRAs for the first time. While ERISA accounts can be protected from creditors at any time, the Bankruptcy Abuse Prevention and Consumer Protection Act only protects IRAs when the owner of the account files bankruptcy under Chapter 7 within the federal court system.

Non-ERISA account types include Traditional and Roth IRAs as well as SIMPLE IRAs and simplified employee pension (SEP IRAs). ( See above “Protection of assets held in non ERISA accounts.).

Protecting Non-Retirement Assets

A large portion of a person’s net worth is tied to assets that are not retirement-related, such as an investment account, a house, or a stake in a company. To protect these assets, a proactive strategy is often needed. This should be developed well before any problems arise.

Titling or Transferring of Assets

Transferring ownership is an easy and cheap way to protect certain assets.

One simple way to protect a home would be to transfer the property ownership of the doctor to the spouse considered to be low-risk. If, for instance, the marriage ends in divorce, or the couple lives in a state that recognizes community property (e.g. Texas and California), then certain complications may arise. Consult your financial advisor or legal representative.

It is important to avoid fraudulent conveyance — transferring illegally property in order to avoid paying a current obligation. This issue generally arises when the debtor transfers assets to a third party as a result of an unfavorable judgement or knowing of a possible legal claim.

Joint Ownership: Alternatives

Joint ownership is common for both “hard assets” such as homes and liquid assets such as bank accounts. Joint ownership can pose certain challenges for an asset protection plan. Generally, claims made against one of the joint owners can lead to the attachment and penalization of the other joint owners.

Certain states, however, allow the marital property to have a “tenants-by-entirety” title. This means that creditors cannot generally take joint assets in order to pay off one spouse’s obligations. To determine if tenants-by-entirety is possible in your state, consult a lawyer familiar with the state laws.

Trusts

Trusts are a way for an individual to give up ownership of assets in their name to a trustee who will hold them in trust on behalf of the designated beneficiary. Trusts must be irrevocable. Revocable trusts, such as living trusts, are ineffective at protecting assets against creditors.

A “foreign” trust is another option. This is usually an irrevocable foreign trust that is held and governed under the laws of the jurisdiction in which it is located. These trusts generally are not subject to the judgments of U.S. courts.

A small number of states have Domestic Asset Protection Trusts, which are trusts that are established in the U.S. to protect trust assets from creditors. These trusts are governed by complex rules and may not deter certain court judgments.

Business Owners

Business owners who are at risk of being sued by employees, patients, or customers should protect their business. It is important to structure your business ownership in a way that makes it expensive or difficult for others to gain access to your assets. You can achieve this by creating a C or S corporation for federal tax purposes. Other strategies include:

Limited Liability Companies and Limited Partnerships Because LLCs and LPs are separate legal entities and assets within them aren’t deemed “owned” by an individual, they are considered to be held in the LLC or LP. A plaintiff who wants to access the assets of an individual will have to sue the LLC or LP and not the owner.

A more advanced way to use LLCs is to create several different LLCs, one for each aspect of the business. For example, you could have one LLC for equipment and another for real estate. This strategy is more expensive, but it creates different legal ownerships of business assets. It may protect these assets from claims made against other parts of the business.

Family Limited Partnerships FLPs are agreements that allow grandparents and parents to name themselves as the general partner and their children as the limited partner. A FLP allows senior family members to transfer their assets, such as cash, corporate stock and real estate, to their children and grandchildren. This removes the assets from their estates and is tax-efficient.

The FLP protects assets from creditors because ownership is transferred to the FLP from the individual. Creditors may target the distributions made by the partnership through a “charging orders” filed with a court. However, this only gives them the right to any distributions and not the assets within the partnership. FLPs must be properly maintained and structured because they are closely scrutinized by the IRS.

College Savings Accounts

Federal protection is provided to programs such as Coverdell Education Savings Accounts and 529 Plans from bankruptcy proceedings.

- Contributions made more than 720 days prior to filing for bankruptcy are 100% excluded from the bankruptcy estate.

- Contributions up to $5,000 made within the last year and less than 720 calendar days before filing for bankruptcy are not included.

- Contributions made within one year of the bankruptcy filing are not included.

- The 529 accounts with the same beneficiary will be grouped together.

- All Coverdell ESAs with the same beneficiary will be aggregated.

- Account beneficiaries must be children, grandchildren, or step-grandchildren of the debtor to be exempted from bankruptcy estate.

IRAs are not the only accounts that can be protected by certain states. College savings programs receive coverage from certain states also.

Captive Insurance: A Way To Mitigate Risk

Both medical professionals and business owners are exposed to unique risks in their respective professions. Over 98% of surgeons will face at least one malpractice claim by the time they turn 65.* Owners of businesses may be exposed to risk when dealing with employees or customers. In order to mitigate these risks, business owners often maintain malpractice or commercial liability coverage.

Physicians and business owners are seeking alternative ways to manage their risk as insurance costs have risen. A captive insurance company is one way to manage risk.**

A medical practice or business can create its own captive insurance company in order to cover all or part of a particular risk. This may allow physicians to lower the coverage limits on their existing malpractice insurance policy or increase the deductible. Over time, the practice can transfer all the risk to the newly formed captive company. Savings from reducing coverage in the existing malpractice insurance policy can be used as a way to fund the captive insurance company.

Captive insurance can be used by business owners to manage many risks, including those related to employment, the environment, interruption of business, and contract breaches. Other benefits include:

- Tax benefits: The premiums paid to fund the captive company are tax deductible expenses. The premium dollars paid to the captive insurance company are not taxable for the company if the annual premiums do not exceed $2.2 Million.

- Asset appreciation: Over time, funds in the captive insurance company could appreciate.

- Asset protection: Funds within captive insurance companies are not generally exposed to claims by potential creditors.

*New England Journal of Medicine August 2011. Most recent data available.

**Establishment of a captive insurance company can be complex and expensive. Working with an experienced professional who is qualified to implement this strategy is essential.

Other Strategies

Most people will find that comprehensive home insurance or malpractice insurance is the best way to protect their assets. Insurance coverage can include:

- Group liability, or “umbrella” coverage

- Long-term care

- Disability

- Malpractice

- Professional liability, also known as “errors-and-omission” insurance (which protects a business from being sued for mistakes or failure to complete work specified in a contract).

Homestead exemption can be used to protect your primary residence against claims from creditors. The amount of protection depends, however, on the duration of ownership.

Most states also have caps on how much equity can be protected. In states that have high or unlimited limits on home equity protection, like Florida and Texas, one way to protect a primary residence is to pay off the mortgage using assets at risk of creditors attaching, such as money or investment accounts.

You are transferring assets (cash or investments) which may not be protected to an asset (such as the home), which may be protected from creditors because of the homestead exemption. Consult an attorney who is familiar with the homestead exemption laws in your state, as these can vary greatly. It is also important to make sure an active Will is in place. To learn more about setting up a Will, our very own Kyle McClain, CFP®, CIMA® was featured in a MoneyGeek article on this exact topic.

Conclusion

Asset protection is a crucial aspect of any comprehensive financial plan. It is not only reserved for high-net-worth individuals or business owners but also relevant for individuals with modest financial assets such as a home and retirement savings. Lawsuits, civil claims, or bankruptcy proceedings can put hard-earned assets at risk, making it essential to implement strategies to safeguard them.

It is important to note that asset protection strategies are complex and should be tailored to individual circumstances. Consulting with qualified tax, financial, or legal advisors is essential to identify specific risks and determine the most suitable methods for protecting assets. While no fail-safe plan exists, a combination of strategies and tools can help individuals maintain their standard of living, preserve their ability to pass assets to heirs or charitable organizations, and mitigate potential financial risks.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.