Market Update – February 2023

Making Sense of The Current Market Environment

Yesterday, the Federal Reserve convened for their first meeting of 2023 and decided to raise the benchmark interest rate by 0.25%. The quarter-point hike brings the target Fed Funds rate to 4.75%, its highest level since October 2007. Comparatively, this latest hike in interest rates represents the second consecutive deceleration in hikes from the Fed. This additional decision to increase interest rates sends in essence a two-sided message to markets: while the Fed believes they have continued to make progress in the fight against inflation, they are not yet satisfied with their economic tightening efforts. The Federal Reserve explicitly said this in their statement noting that inflation “has eased somewhat but remains elevated” and that their interest rate policy warranted “ongoing increases in the target range”. In the immediate aftermath of the announcement, markets had a relatively modest reaction. The big moves arrived during Chairman Powell’s post-hike press conference. Equity and bond markets sharply rallied with the S&P 500 ending the day up over 1% and closing at its highest level since last August. 10-year Treasury yields fell to nearly 3.4%.

Clearly the decision from the Fed was largely anticipated by investors. Markets had priced this interest rate hike well before the Federal Reserve’s announcement. However, the question that remains is whether the market or the Fed has a more accurate prediction for the path of interest rates. While Chairman Powell didn’t reach the level of hawkish rhetoric defining his statement last summer at Jackson Hole, his latest words weren’t particularly dovish. The market for interest rate futures implies the level of interest rates topping off at 4.9% before ending the year near 4.5% (implying a half point cut), the Federal Reserve’s median “dot plot” forecast has interest rates rising and staying at a rate just over 5% to end 2023. Regardless, since a steep selloff in mid-December the market has had an encouraging rally that has carried over through the first month of this year.

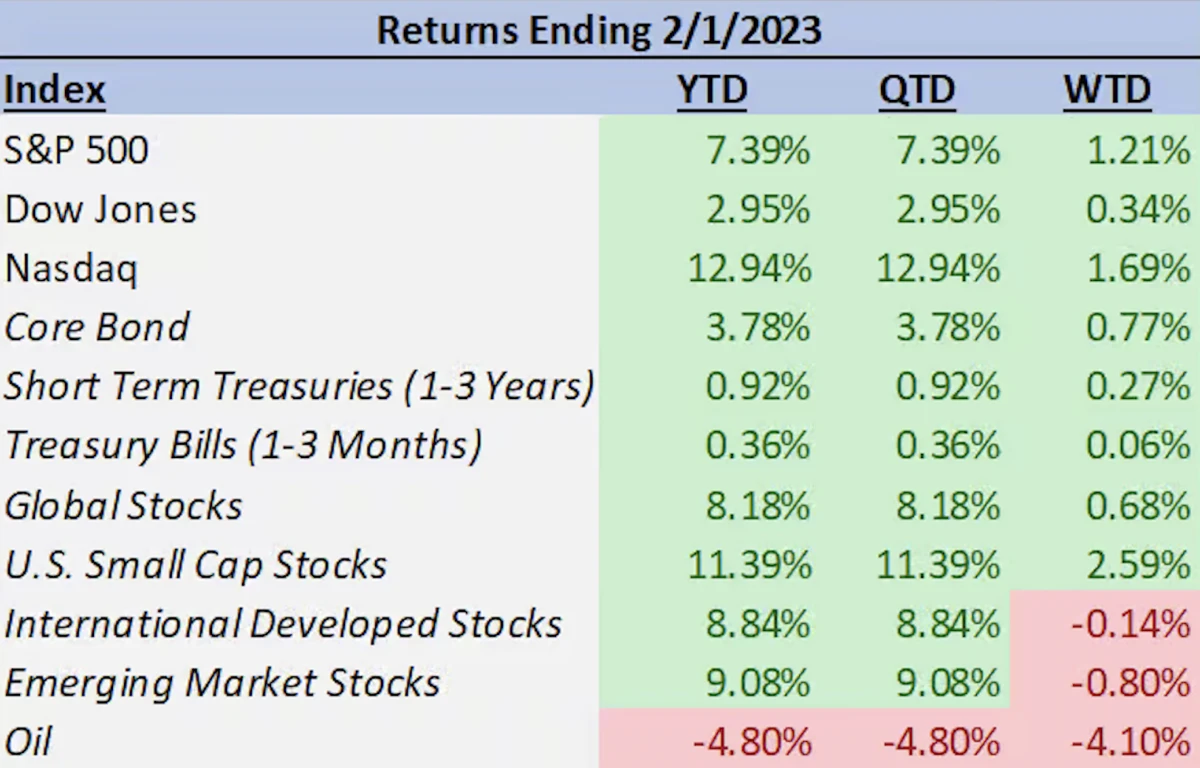

The story for the market early into the year has seen the old market adage of “last year’s losers are this year’s winners” be true so far. There’s no guarantee that any trend will continue, but the high growth/technology heavy NASDAQ has led the start of 2023 with a near 13% return after having fallen over -30% in 2022. In contrast, the Dow Jones, a more value leaning index, while positive (up 2.95%) has been the weakest of the above indices after having been the strongest performer in 2022 losing close to -7%. The broader large cap equity market, represented by the S&P 500, is up over 7%. Emerging market stocks and domestic small cap stocks, which underperformed the S&P 500 last year, have outperformed to start 2023. The only continuing trend so far has been the outperformance of international developed stocks relative to their domestic counterparts, as the MSCI All Country World Index ex US has returned 8.84% year-to-date. Bonds, which were crushed last year, have also seen strong positive returns to start the year at 3.78%.

Likely driving both the market’s performance and its forecasting of the Federal Reserve’s future policy moves has been some of the recent economic data. Q4 2022 GDP reported a quarter-over-quarter gain of 2.9%, higher than the consensus economist estimate of 2.6%. This occurred despite personal consumption falling short of estimates at 2.1% (forecasted 2.9%). The rate of economic growth describes an economy that is growing faster than expected despite weaker consumption. Consumption is a demand driven force that is inextricably tied to inflation. It is also a primary target of the Fed’s current policy. Meanwhile, the latest inflation data has been mixed but mostly positive. The Consumer Price Index (CPI) and its Core (CPI ex food and energy) counterparts both reported December values in line with expectations. Headline CPI reported a -0.1% decline month-over-month while the core number saw a 0.3% modest acceleration compared to the 0.2% increase in November. The data from the Producer Price Indices painted an even rosier disinflationary picture as the headline PPI month-over-month number saw a -0.5%, significantly lower than the -0.1% consensus estimate. The one negative report was from the December Personal Consumption Expenditure (PCE deflator) release which revealed a surprise increase of 0.1% month-over-month instead of the near no change in value forecasted. Overall though, with year-over-year CPI down to 6.5% from the July 2022 high of 9.1%, and having printed a lower figure each month since the high, the Federal Reserve appears to have seen some substantial rewards from their efforts. If one were to take the last six prints for month-over-month CPI and annualize that collective pace, the projected CPI rate would be lower than the Fed’s long-run goal of 2%. The current trend in inflation and resilient level of economic growth may have the market and investors becoming bigger believers in the chance of a soft landing for the economy.

A large determinant in the path to either a soft landing or recession will be how corporations navigate the quickly changing macroeconomic environment. Among the most important gauges that will largely drive stock market returns will be earnings performance. We are still early in the current earnings season (Q4 2022), but with just over 230 companies in the S&P 500 having reported thus far and some of the biggest names reporting soon, we will soon have an appropriate sample size to sense a pattern of how both those individual companies and their corresponding sectors have performed and expect to perform going forward this year. From a pure sales and earnings growth perspective, the best performers so far have been in the energy, consumer discretionary, utilities, and industrial sectors. The worst absolute performers in those metrics have come from the materials, technology, financial, and communications sectors. Relative to analyst expectations though, the market with the exception of earnings for the industrials and communications sectors has not seen much in the way of downside surprises which is a positive sign for valuations.

As we head further into the new year, we believe the trajectory of the market will be primarily dictated by the need for further evidence in sustaining a decline in inflation, investor sentiment regarding the Federal Reserve’s policy direction, and the general health of the underlying economy as it digests these policy actions. Companies will be tested as they continue to adjust to the higher interest rate environment and balance the dynamics of navigating inflation and a recovering supply chain. Geopolitical tensions, spanning across the globe from Ukraine to Taiwan, will continue to be in the picture as well, with escalation or de-escalation being narrative defining elements. On the domestic front, potential political conflict over the debt ceiling could be a catalyst for uncertainty but a compromise leading to its extension is our base case. Given current valuations and our belief that the rise in interest rates is closer to the peak than it is to the middle, a balanced mix of equities diversified in style (growth and value), market cap, and geographical representation is an important component to a portfolio for long-term growth. The appropriate equity mix should be risk-tolerance focused with the ballast of a fixed income allocation and diversifying alternatives. With the starting point for yields having shifted higher, the hedge nature of bonds is in a seemingly much more favorable position going forward.

All in all, we are cautiously optimistic for 2023 and while risks will always exist, we believe that our current positioning and portfolio construction are built to navigate these turbulent environments so that our clients reap the long-term rewards of potential economic and market growth ahead. As always, if you have any questions please do not hesitate to contact our team.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.