Q2 Segment Rates Reduce ExxonMobil Pension Lump Sums

Segment rate Changes and How They Affect The ExxonMobil Pension Plan

As inflation drives prevailing bond interest rates higher, a knock-on effect that directly impacts employees of ExxonMobil is the reduction of lump-sum distribution value for the ExxonMobil pension plan. The vast majority of current employees are subject to a lump-sum calculation that uses “Segment Rates” to determine the present value of the pension annuity payments. For many employees, rolling over the lump sum of the pension value into an IRA is an attractive option at retirement. Increased Segment Rates reduce the lump-sum – in some cases dramatically.

What To Do About Q2 Rates?

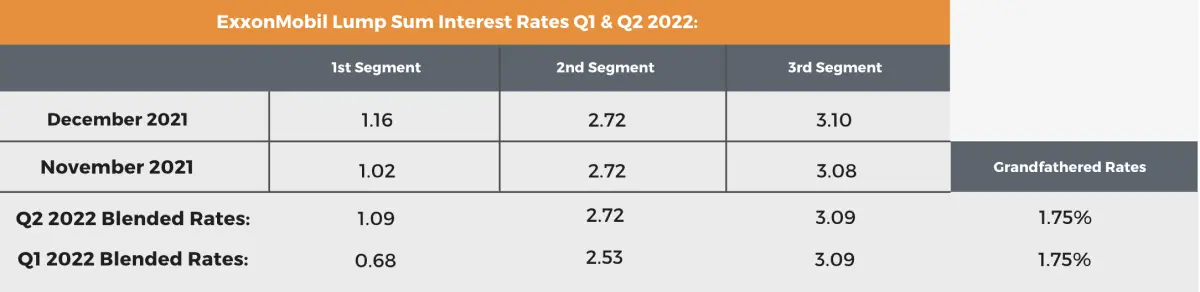

After the Covid-19 crisis drove interest rates to historic lows, rates have generally been on an upward trajectory for the past 18 months. For individuals retiring in Q1, the Segment Rates were a bit lower than the rates that have been published for Q2 rates as seen below:

While Segment 3 rates remain the same, Segment 1 and Segment 2 are the rates that determine the present value of the first 20 years of annuity payments from the pension, and they’re quite a bit higher than Q1 rates. In general, a 1% move up in overall rates corresponds to a ~10% reduction in lump-sum values, so Segment 1 moving 0.4% and Segment 2 moving 0.2% is meaningful and could have employees considering how to optimize their retirement strategy given this trend in rates.

Am I Working for Free?

This is a commonly asked question by those close to retirement when we start to see rates creeping higher. Pension lump-sum values are frequently in the $1-2 million range, so a 1% move in segment rates over the course of the year could cost a retiree well into the six-figure range in terms of lost value. Other factors that can help to offset this loss by working longer include additional pension service credit or potential salary increases – everyone’s individual circumstances are different, so it’s important to discuss these matters with an experienced professional who can help you make an informed decision.

Will Rates Continue To Go Higher?

While it can be difficult to predict what future segment rates will be, it’s interesting to note that each quarter’s rates are calculated by averaging the rates from the 4th and 5th month PRIOR to the beginning of the quarter as published by the IRS here. That means Q2 rates were determined by rates that existed in November and December of 2021, and Q3 rates will be determined by February and March data in 2022.

A good metric to watch for the direction of prevailing rates is the 10-year U.S. Treasury Bond yield. While in November/December it fluctuated in the ~1.5% range, it’s over 2% today, making it very likely that Q3 rates will rise yet again. This can be useful information for individuals considering the timing of their retirement.

Can I Afford To Retire Now?

If rates are likely to continue to increase, the next logical question to ask is: Should I retire now? Many individuals close to retirement may want to consider separating before a larger effect occurs on their lump-sum, but just aren’t sure if they’re financially prepared.

The Rhame & Gorrell team is pleased to offer complimentary retirement readiness assessments for any individual considering their options. Schedule a time today with one of our Certified Financial PlannerTM (CFP®) professionals via the link below to get a better idea of where you stand and the ideal strategy for you moving forward.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.